You’d think, from listening to politicians and news anchors, that the cost of prescription drugs is the highest it has ever been, and continuing to rise out of control. However, in reality, growth in drug prices this year was half of last year and the average out-of-pocket cost to consumers has decreased. This information comes from a new report from The QuintilesIMS Institute.

According to the report, growth in spending on prescription medications in the United States fell in 2016, as competition increased among manufacturers, and payers focused on efforts to limit price increases. According to the report,

Drug spending grew at a 4.8 percent pace in 2016 to $323 billion, less than half the rate of the previous two years, after adjusting for off-invoice discounts and rebates. The surge of innovative medicine introductions paused in 2016, with fewer than half as many new drugs launched than in 2014 and 2015. While the total use of medicines continued to climb—with total prescriptions dispensed reaching 6.1 billion, up 3.3 percent over 2015 levels—the spike in new patients being treated for hepatitis C ebbed, which contributed to the decline in spend. Net price increases—reflecting rebates and other price breaks from manufacturers—averaged 3.5 percent last year, up from 2.5 percent in 2015.

New medicines that have been introduced in the past two years are where most of the total spending growth comes from, representing at least half of total spending growth. These treatments treat common conditions, such as cancer, autoimmune diseases, HIV, multiple sclerosis, and diabetes. The prospects for continued innovation over the next five years are fueled by a robust late-phase pipeline of more than 2,300 novel products that include over 600 treatments for cancer alone.

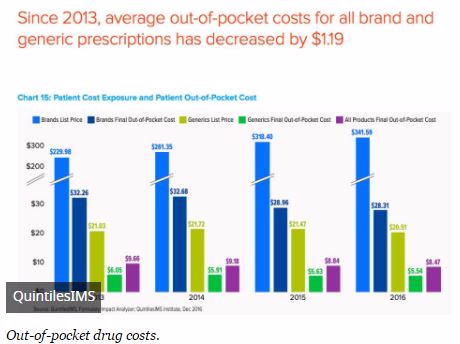

Out-of-pocket costs to patients are down $1.18 to prescription, to $8.47, since 2013. But on branded medicines, out-of-pocket costs have increased $111.61, or 48%, to $341.59. On average, medicines are cheaper. But in exceptional cases, patients are paying much more.

However, even with prices on a slower rise, it doesn’t feel that way to consumers, who are more frequently being asked to pay more on branded drugs, while their insurers and employers pocket discounts. New drugs for conditions like cancer and hepatitis C, known as specialty medicines, tend to be very expensive. And some companies have attempted to capitalize on high prices by jacking up prices dramatically, as occurred with Valeant Pharmaceuticals and Martin Shkreli, and have been publicly vilified for it.

Patients tend to not get the discounted rates negotiated by their insurers or by pharmacy benefit managers, except in the form of lowered insurance premiums. If a patient is asked to pay a share of the drug price, it’s usually off the list price.

List prices on existing drugs increased 9.2% last year, compared to 12% in 2015, QuintilesIMS says. But net prices grew at just 3.5%. Essentially, where market forces are keeping prices down, consumers are being left out of the competition, forced to pay full price when their employers and insurance companies are pocketing a sale.

To recap, the highlights of this report included the following:

- After accounting for discounts and rebates, spending on medicines grew just 4.8 percent in 2016.

- Prices for brand-name medicines increased just 3.5 percent after accounting for negotiated discounts and rebates.

- Prices for brand-name medicines after accounting for negotiated discounts and rebates is projected to grow between 2 percent and 5 percent through 2021. This lower spending follows the loss of patent protection projected to total $103 billion through 2021, which excludes biologics that will face competition from biosimilars entering the market.

- More than half (52 percent) of commercial patients’ out-of-pocket spending for brand medicines were filled in the deductible or with coinsurance, meaning patients paid the full list price for their medicines, even if their insurer receives a discount.